ISO PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE FORMS ANALYSIS

(July 2018)

|

|

INTRODUCTION

Insurance Services

Office (ISO) CG 00 37–Products/Completed Operations Liability Coverage Form

(Occurrence Basis) is analyzed first. This analysis is based on the 04 13 edition

and differences between the 12 07 and the 04 13 editions will be in bold.

At the end of this

article is a discussion on the differences between the CG 00 37 and the CG 00

38–Products/Completed Operations Liability Coverage Form (Claims-Made Basis).

CG 00 37–PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE FORM (OCCURRENCE BASIS)

CG 00 37 begins by stating that certain provisions in the form restrict coverage. It encourages the insured to carefully read the entire policy to determine its rights and duties and to determine what is covered and not covered. It also points out that the insurance company uses the terms you and your to refer to the named insured and that an insured is any person or entity qualifying as such under Section II–Who Is An Insured. The terms we, us and our refer to the insurance company providing the coverage. It also directs attention to Section V–Definitions because understanding the definitions is critical to understanding the coverage form.

SECTION I–COVERAGES-BODILY INJURY AND PROPERTY DAMAGE LIABILITY

1. Insuring Agreement

a. The insurance company agrees to pay amounts

for which the insured is legally obligated to pay as damages for bodily injury

and property damage covered by this insurance. This expansive statement is then

limited by stating that only bodily injury and property damage that fits within

the defined products-completed operations hazard is covered.

The insurance company has not only the right but also the duty to defend

the insured when suits are brought that demand damages. However, this duty and

right applies only when those suits apply to damages that might be covered by

this insurance.

Once the insurance company is involved, it takes control and decides

when and how to investigate and/or settle any claim or suit. The settlement

amount is limited as described in Section III–Limits of Insurance. The duty of

the insurance company to defend ends when the applicable limit of insurance is

used up by actual payment of judgments and settlements.

It is very important to review the Supplementary Payment Sections in

this coverage form because it lists important sums that are paid in addition to

the obligations described in this insuring agreement.

b. Coverage applies to bodily injury and property damage caused by an occurrence that takes place in the coverage territory. The bodily injury and property damage must occur during the policy period.

Note: The occurrence is not required to take place during the policy period and the bodily injury and property damage are not required to take place within the coverage territory.

|

Example: Hedgehog Industries manufactures hedge clippers in Indiana. On 1/1/18 a box of clippers are shipped to London without having the required warning labels attached. Millicent buys one of the hedge clippers on 7/1/18. She cuts her hand with the clippers on 7/15/18 and, due to complications for the injury, dies on 8/15/18. Hedgehogs PCO policy runs from 7/1/18-7/1/19 and the next is from 7/1/19-7/1/20. If a claim is presented, the 7/1/19-7/1/20 policy would respond because the bodily injury occurred during that policy period. |

Bodily injury or property damage that occurs before the policy period may be covered under the current policy period but only if no one was aware that it had occurred during a prior policy period. This means that no insured knew of the injury or damage and also that no employee authorized by the named insured to give or receive notice of an occurrence or a claim knew of it. On the other hand, when there is such knowledge, any continuation, change or resumption of that prior policy bodily injury or property damage is considered having been known before the policy period and is therefore not covered.

Note: This is only discussing the bodily injury and property damage, not the occurrence. The insured could be aware of any occurrence without any consequences. It is only knowledge of either bodily injury or property damage that impacts coverage.

c. When bodily injury or property damage occurs during the policy period all continuation, change or resumption of that particular bodily injury or property damage is covered as part of that specific policy period even if the resumption, change or continuation takes place in one or more following policy periods.

d. The policy explains exactly when bodily injury or property damage is considered to have become known. It is the earliest of the following times when any insured or employee authorized by the named insured to provide notice of a claim:

· Reports the bodily injury or property damage to any insurance company

· Receives a damage demand that alleges either bodily injury or property damage

· Becomes aware that bodily injury or property damage has occurred or has begun to occur

Note: The means by which the named insured or its authorized employee becomes aware of a loss is not limited. It could be an Internet report, an observation, or any other manner or means.

e. Bodily injury damages are not limited to only the injured party’s claims.

It includes damages for care, loss of services or death resulting at any time

from the claimed bodily injury submitted by any party.

2. Exclusions

The very broad coverage provided in the insuring agreement above is

limited by this exclusion section. The coverage does not apply to the following:

Note: There are many exceptions within the exclusions so it is very important to read the entire

exclusion in order to determine what is covered.

a. Expected or Intended Injury

Coverage does not apply to bodily injury or property damage which the

insured either expected or intended. An exception to this exclusion covers

bodily injury resulting from the insured using reasonable force to protect

persons or property.

Note: This exclusion must be viewed from the

eyes and mind of the insured not that of the witness or the person injured.

Related Article: Expected Or Intended Injury Exclusion

b. Contractual Liability

There is no coverage for bodily injury or

property damage in cases where

the insured must pay damages based on contractually assumed obligations. There

are two exceptions to this exclusion.

·

One is

if liability would have existed without a contact or agreement. This ensures

that the mere presence of a contract does not void coverage included in the

coverage form.

·

The

second is just as simple. Coverage applies if the liability assumed is within an

insured contract, as defined in the coverage form that went into effect prior

to the bodily injury or property damage.

Attorney fees and other litigation expenses are considered damages, and

therefore covered, but only if they were also assumed in the insured contract

and then only for allegations of damages covered by this coverage form.

Note: The Supplementary Payments section of this

coverage form clarifies that the defense expenses of an indemnitee are

Supplementary Payments and not included in the limits of insurance under

certain circumstances. However, under other circumstances, they are.

c. Liquor Liability (04 13

change)

The insurance company does not pay for bodily injury or property damage for which any insured may be liable because of any of the following:

·

Causing

or contributing to the intoxication of any person

·

Furnishing

alcoholic beverages to a person under the legal drinking age

·

Furnishing

alcoholic beverages to a person already under the influence of alcohol

·

Any law

relating to the sale, gift, distribution or use of alcoholic beverages.

The

following significant changes are in the 04 13 edition:

Any of

the actions described above may result in an occurrence. In that case, there is

also no coverage if any of the following claims related to that occurrence are

brought against the insured:

·

Hiring, employing, monitoring,

or training others

·

Noting that a person

is intoxicated and either providing transportation to that person or failing to

provide such transportation

This exclusion does not apply if the named

insured is not in the business of manufacturing, distributing, selling,

serving, or furnishing alcoholic beverages.

The named insured may not serve

alcoholic beverages but does allow others to bring such beverages onto its

premises. In that case, this exclusion does not apply even if a license is

required to operate this way. It is not treated as a liquor-related business

even if it charges a fee to consume the beverages on the premises.

This could be a very important exclusion for online or mail order

sellers of alcoholic beverages because of the difficulty of verifying the legal

age and identity of prospective purchasers. In cases such as these, the named

insured should purchase Liquor Liability Coverage.

Related Article: Liquor Liability Occurrence and Claims-Made

Coverage Forms Overview

d. Workers Compensation and

Similar Laws

There is no coverage for requirements or obligations of the insured

imposed by any workers compensation, disability benefits, unemployment

compensation or similar law. The intent of this exclusion and the Employers

Liability exclusion is to eliminate the possibility of the insured being

indemnified under this coverage form for an injury covered by workers

compensation or employer’s liability coverage forms and policies.

e. Employers Liability

Bodily injury to an employee of the insured as a

result of his or her employment by the insured is not covered. Such

injury to an employee during performance of duties that are in conjunction with

the conduct of the insured’s business is also excluded. Bodily injury to the

spouse, children, parents, brothers or sisters of that employee that occurs

because of the bodily injury of the employee is also not covered.

This exclusion applies whether the insured is liable as an employer or

in any other capacity, or whether the insured must share damages with or repay

someone else who must pay damages because of the injury.

An important exception to this exclusion is that it does not apply to

liability the insured assumes under an insured contract.

Note: This

clarification is particularly important because of the widespread use of

contractors, subcontractors, independent contractors or leased employees and

much of the uncertainty with respect to who is responsible for injuries to

those workers.

f. War

There is no coverage for bodily injury or property

damage caused directly or indirectly in any way by war, undeclared war and

civil war. There is also no coverage if the injury or damage is from warlike

action by a military force. This exclusion also applies to actions taken by a

government to prevent or defend against an expected or actual attack by any

government or other authority using military personnel or agents. It also

applies to rebellion, revolution, insurrection or unlawful seizure of power and

the action taken by the government to prevent or defend against any of these.

g. Damage to Property

The insurance company does not pay for property damage to:

(1) Property the named insured owns, rents or occupies. Costs or expenses

the named insured or any other party incurs to repair, replace, enhance,

restore or maintain such property for any reason are not covered even if they

are incurred in order to prevent injury to persons or

damage to property of others.

(2) Premises the named insured sold gave away or abandoned. This

exclusion applies when the property damage arises out of any part of those

premises

(3) Property loaned to the named insured

(4) Personal property in the insured's care, custody or control

There are two exceptions:

· Paragraph (2) above does not apply if the location is the named insured's work and the named insured never occupied or rented the location or held it for rent.

Note: This is particularly important to homebuilders that build and sell homes. Without this exception, there would be no coverage once the home was sold. However, this exclusion does apply if the named insured used the home as an office or rented it out prior to selling it.

|

|

|

|

Coverage applies because it is a model home and never rented or occupied. |

Coverage does not apply because it has been occupied as an office. |

·

Paragraphs

(3) and (4) above do not apply to any liability assumed under a sidetrack

agreement.

Note: Railroad sidetrack agreements are covered

contracts under the PCO Coverage Form.

h. Damage to Your Product

Coverage does not apply to property damage to the named insured's product

arising out of it or any part of it.

|

|

|

Example: The named insured

manufactures gas water heaters. A water heater malfunctions, explodes and

destroys the furnace next to it and other items in the utility room. Coverage

does not apply to the destroyed water heater but it but would apply to the

furnace and other property damaged by the explosion. |

i. Damage to Your Work

There is no coverage for property damage to the named insured's work that

arises out of it or any part of it included in the products/completed

operations hazard.

There is an exception to this exclusion that

applies to work performed by a subcontractor that the insured hired. Coverage

applies if the damage to property is the result of the subcontractor’s

completed work.

|

Example: The named insured is building a house. The electrical wiring in the house causes a fire. The property damage as a result of the fire is not covered. However, coverage does apply if a subcontractor installed the wiring for the named insured. |

Related Court Cases:

Work Project Exclusion Held Applicable to Control of Project by Construction Manager

j. Damage to Impaired Property or Property Not Physically Injured

If a defect, inadequacy or dangerous condition in the named insured’s

work or product impairs property but does not physically damage it, there is no

coverage. There is also no coverage when the named insured or its subcontractor

either is late in fulfilling or fails to perform items required in its contract,

and that lack of action results in property being impaired. However, this

exclusion does not apply to loss of use of other property arising out of the

sudden and accidental physical injury to the named insured completed work or

product.

|

|

Example: Peckin

Switch, Inc. manufactures assembly line switches. Peckin sold a batch of

defective switches to be installed as replacements during routine assembly

line maintenance. After the switches were installed, the assembly lines could

not be restarted, resulting in additional downtime. Assembly lines were

impaired because of Peckin’s defective switches but were otherwise undamaged.

All claims made against Peckin are excluded. |

Note: There is no standard ISO endorsement currently available to buy back this coverage or to delete this exclusion.

k. Recall of Products, Work or Impaired Property

There is no coverage

for any incurred loss, cost, or expense when the named insured’s product, work,

or any impaired property is recalled or withdrawn from the market or from any

use. There is also no coverage for costs and expenses the named insured or

others incur because they can no longer use the recalled or withdrawn item.

This exclusion also applies to withdrawal, recall, inspection, repair,

replacement, adjustment, removal, and disposal expenses.

This exclusion applies

when the recall or withdrawal is due to a defect, deficiency, inadequacy, or

dangerous condition in the item recalled.

Note: CG 00 66–Product Withdrawal Coverage Form reimburses the named insured's product withdrawal expenses because of a product withdrawal to which the coverage provided applies.

l. Electronic Data (04 13 change)

Coverage does not apply to damages arising out of the loss of, loss of

use of, damage to, corruption of, inability to access or inability to

manipulate electronic data.

This exclusion does not apply to bodily injury. (04 13

addition)

Electronic data is defined as information, facts or programs used with

computer software or any other media used with electronically controlled

equipment.

SUPPLEMENTARY PAYMENTS

Note: Payments made under this section do not

reduce the limits of insurance.

1. Only when the insurance company investigates or settles a claim or defends a suit against an insured, will

the insurance company pay the following amounts.

a. All expenses

incurred that relate to the claim.

Note: This provision is

important because these expenses can be substantial and could reduce the

available limits if they were included in the limits of insurance that apply.

b. The cost of bonds

to release attachments. This is limited to only the cost of bond amounts that

are within the limit of insurance that applies. The cost of the excess amount

of the bond is at the insured’s expense. The insurance company is not required

to furnish the bonds.

c. Reasonable

expenses the insured incurs at the request of the insurance company to assist

it in investigating or defending a claim or suit. This includes up to $250 per

day in lost earnings if the insured is required to be away from work.

d. A suit’s court costs that

are the insured’s responsibility. These

costs do not include attorney fees or expenses for which the insured is

responsible.

Note: This attorney’s fee

restriction can be very costly to the insured, especially if the insured loses

the law suit and the court assesses the other party’s attorney’s fees against

the insured.

e. Prejudgment

interest, for which the insured is responsible, on the part of any judgment the

insurance company pays. However, if the company offers to pay full policy

limits, it does not pay any prejudgment interest that accrues during the period of time after it makes the offer.

f. Interest that

accrues on the full amount of any judgment in the period between the entering

of the judgement and the insurance company paying, offering to pay or

depositing with the court its portion of that judgment.

2. If an indemnitee

of the insured is named in a suit brought against the insured and the insurance

company defends the insured, the company will also defend the indemnitee but only if the following

conditions are met:

a. The suit against

the indemnitee must meet the following two criteria:

- The damages it seeks must be for

liability of the indemnitee that is assumed by the insured

- The liability must have been assumed

by the insured in a contract or agreement

b. The insurance

provided by this coverage form must apply to the assumed liability

c. The insured

assumed the obligation to defend or the cost of defense in the same contract or

agreement where the liability was assumed

d. Based on what the

insurance company knows about the occurrence and the allegations contained in

the suit, there appears to be no conflict between the respective interests of

the insured and the indemnitee

e. Both the insured

and the indemnitee ask the insurance company to handle the defense of the

indemnitee in the suit and agree to have the same legal representative handling

the interests of both parties

f. The indemnitee has

its own set of conditions. The following must be in writing:

·

Agree

to cooperate with the insurance company while they investigate, defend or settle

the suit.

·

An

agreement to immediately send copies to the insurance company of suit-related demands,

notices, summonses or legal documents.

·

Agree

to provide notification to any other insurer who provides coverage for the

indemnitee.

·

A cooperation

agreement with the insurance company as it coordinates other insurance

available to the indemnitee.

·

Provide

authorization so that the insurance company can obtain records and other

information related to the suit.

·

Authorize

the insurance company to conduct and control the defense of the indemnitee in

the suit.

Subject to all criteria in this item 2. being met, attorney fees and all litigation expenses are paid without

reducing the limits of insurance. The insurance company's obligation to defend

the indemnitee ends when the applicable limit of insurance is exhausted by

payment of judgments or settlements or when the conditions and agreements in

this item 2. above are not met.

|

Example: Gregory manufactures tea pots. Endorsement CG 20 15–Additional

Insured Vendors is attached so all of Gregory’s vendors are considered

additional insureds for Gregory’s tea pots. Marge is badly burnt when the

handle of her tea pot, which had been purchased from Cozy Tea, breaks. She

sues Cozy Tea and Gregory. Gregory’s insurance coverage agrees to represent

both Cozy Tea and Gregory and pay all defense expenses. However, Cozy Tea is

not satisfied with the handling of the case and refuses to honor the

conditions as outlined. Cozy Tea’s owner demands separate representation

because she believes her case is being compromised by being tied to Gregory.

Once this occurs, her defense costs are no longer outside limits. The case continues and Cozy Tea has separate representation, but

all expenses incurred reduce the limit of insurance available to pay for the

loss. |

SECTION II–WHO IS AN INSURED

1. This section identifies

insureds with respect to this insurance. This applies based on the type of entity or entities selected on the

declarations:

a. If the named insured is an individual, the individual is the named

insured as well as the named insured's spouse. However, this situation is not

all-inclusive. Their status as named insureds is limited to operations of the

business for which the named insured is the sole owner.

|

Example: Katie Fram, a sole proprietor,

sells bird houses. Both she and her husband, Patrick, are insureds. In

addition, Katie is the sole proprietor in another venture in which she sells

birdseed. Here again, both she and Patrick are insureds. However, if she and her

sister owned the birdseed business as a partnership, coverage would not apply

to the partnership. |

b. If the named

insured is a partnership or joint venture, the partnership or joint venture is

an insured. In addition, the members and partners of the named insured along

with their spouses are insureds but subject to a condition. The condition is

that their status as insureds is limited to operations of the named insured's

business.

|

Example: Jasper and |

c. If the named

insured is a limited liability company, the limited liability company is an

insured. In addition, members of the company are insureds

but their status is limited to their conducting the named insured's business.

The named insured's managers are also insureds but their

limited status is only while performing their specific duties as managers.

d. If the named

insured is any other organization, it is an insured. In addition, the executive

officers and directors are insureds but the insured

status is limited to their performance of their duties as officer or directors.

Stockholders are also insureds but their status is very

limited to only liability imposed as stockholders.

2. The following are also insureds:

a. Employees, excluding executive officers and managers of a limited

liability company, are insureds within the narrow range of activities within

the scope of their employment or while conducting the named insured's business.

(1) Employees are not insureds for bodily

injury:

·

To the

named insured, its partners or members.

·

To

other employees. However, this limitation applies only while the other employees

are in the course of their employment or performance

of duties related to the conduct of the named insured's business

·

To a

relative of any co-employee as a consequence of the

paragraph above

·

Where

an obligation exists to share damages with or repay others for damages because

of injury described in the two bulleted items above

·

When an

employee provides or fails to provide professional health care services

(2) Employees are also not insureds for

property damage to property owned, occupied, used by, and rented to, in the

care, custody or control of any of the following:

·

The

named insured

·

Employees

of the named insured

·

Partners

or members of the named insured.

This property damage restriction also

extends to property over which any of the above exercise physical control.

b. Any party other than an employee acting as the named insured's real

estate manager.

c. If the named insured dies, the temporary legal

custodian of the named insured’s property. This status applies only until a

legal representative is appointed. The status is limited to only the liability

resulting from maintenance of the property.

d. If the insured dies, the properly appointed legal representative but

only while carrying out its duties as the legal representative.

Note: The legal representative assumes all of the

deceased named insured's rights and duties. This goes beyond the standard

insured status and extends to rights to cancellation, conditions and other

elements assigned only to named insureds.

3. Any newly formed or acquired organization qualifies as a named insured

if no other similar coverage is available to it. This does not include

partnerships, joint ventures or limited liability companies the named insured

owns or over which it has majority interest. This provision applies for only 90

days after the organization is formed or acquired, or until the end of the

policy period, whichever comes first. In addition, coverage does not apply to bodily

injury or property damage that occurred before acquisition or formation of the

organization.

No party is an insured concerning conduct of any current or previous

partnership, joint venture or limited liability company not shown on the

declarations as an insured.

Note: In addition to the parties included as insureds as outlined above, ISO has produced numerous endorsements used to add a variety of additional insureds under certain circumstances or limited to specific purposes.

Related Article: ISO Products/Completed Operations Liability Coverage Forms Available Endorsements and Their Uses

SECTION III–LIMITS OF INSURANCE

1. The most the

insurance company pays are the Limits of Insurance on the declarations, subject

to the rest of this section. This is regardless of the number of insureds,

claims made or suits brought and number of parties

making claims or bringing suits.

|

|

Example:

Parrott and Keet are partners in the Birds R Us pet store. Keri is attacked

by a purchased parrot and sues Parrott and Keet individually as well as the

Birds R Us partnership. Although there are three claims presented, only one

occurrence limit will be available for the loss. |

2. The Aggregate

Limit is the most paid for damages because of bodily injury and property damage

included in the products/completed operations hazard.

|

Example: Listening Ears, Inc.’s Products/Completed Operations Liability Coverage Form has a $3,000,000 aggregate limit. Ten products claims for ten separate customer injury claims are presented during a single policy year. All the losses are covered, the injuries occur during the policy period, and the total amount of the ten claims is $4,000,000. This coverage form responds only up to the $3,000,000 aggregate limit. |

3. The Each

Occurrence Limit is the most paid for the total of damages arising out of a

single occurrence. This is subject to the Aggregate Limit.

The final part of this section clarifies how the limits of insurance

apply in a policy period. They apply separately to each consecutive annual

period and to any remaining period of less than 12 months. The period begins

with the coverage inception date on the declarations. A policy period may be

extended for an additional period of less than 12 months. When that occurs the additional extended period is treated as part of

the last preceding period for the purpose of determining the limits of

insurance.

|

Example: Purple Punch’s policy has a policy inception date of 1/1/18. A decision is made to rewrite all policies in order to gain a common expiration date of 7/1. Purple Punch can either cancel on 7/1/18 and have a new policy on that date or extend the existing policy to 7/1/19. Unless there is a reduction in coverage because of a policy edition change, Purple should be advised to replace the policy on 7/1/18. |

|||

|

Option 1: |

Limits |

Option 2: |

Limits |

|

1/1/18 – 7/1/18 |

$1,000,000 |

1/1/18-7/1/19 |

$1,000,000 |

|

7/1/18-7/1/19 |

$1,000,000 |

||

|

Using option one, Purple Punch would have a unique

$1,000,000 aggregate available for the first six months of coverage and then

a separate $1,000,000 available for the next 12-month policy period. |

In option two, Purple Punch would have only $1,000,000

aggregate for the entire 18 months. |

||

SECTION IV–PRODUCTS/COMPLETED OPERATIONS LIABILITY CONDITIONS

1. Bankruptcy

If the insured or the insured's estate becomes bankrupt or insolvent,

the insurance company is not relieved of its obligations under the

Products/Completed Operations Coverage Form.

2. Duties in the Event of Occurrence, Claim or Suit

The named insured has a

number of duties to perform when a situation that might result in a

claim occurs and also if a claim or demand for coverage is presented:

a. The named insured must inform the insurance company when there is an occurrence

that may result in a claim or demand. The notice must be as soon as practicable

and provide information concerning how, when and where the event took place.

The notice should also include the names and addresses of all injured parties

and any witnesses along with a description of the nature and location of any

injury or damage that are a result of the occurrence.

b. Concerning claims made or suits brought, the named insured must

immediately record the details of the claim or suit and the date on which it

was received. The insurance company must be notified of the claim or suit as

soon as practicable. A verbal notification is not sufficient. It must be

followed up by timely written notice.

c. Every insured involved in or with the claim must:

·

Provide copies of demands, notices, summonses and

legal documents received in conjunction with the claim or suit immediately to

the insurance company

·

Authorize and grant approval for the insurance

company to obtain records and other needed information

·

Cooperate with the insurance company as it investigates

and/or settles the claim or defends the suit

·

Only when requested by the insurance company, assist

it in enforcing rights against a person or organization that may be liable to

the insured for injury or damage covered by this insurance

d. No insured may voluntarily make any payments, assume any obligations or

incur any expenses other than first aid without the insurance company's consent.

The insured does have permission to do any of the above but only at its own cost

or expense.

Related Court Case: Ten Year Delay of Claim Relieved Insurer

of Defense and Indemnification of Housing Authority is an example of the

potential impact of improperly notifying the insurance company of a claim.

3. Legal Action Against Us

No party has the

right to join the insurance company in any manner, bring the company into a

suit claiming damages from an insured or sue the insurance company unless all of the policy terms and conditions have been completely

met and complied with.

The insurance

company can be sued to recover on an agreed settlement or on a final judgment

against the insured. However, the insurance company is not liable for damages that

would not be covered by this coverage form. It is also not liable for amounts in excess of the limit of insurance.

The term “agreed

settlement” is a settlement where a release of liability is signed by the

insured, the insurance company and the claimant or the claimant's legal

representative. This settlement would have been reached out of court.

4. Other Insurance

The insurance company's obligations to pay are limited if other valid

and collectible insurance is available that applies to the loss, as follows:

a. Primary Insurance

The insurance provided under this coverage form is primary. The

insurance company has the first obligation to pay unless any other insurance available

is also primary. When there is other primary coverage, refer to b. Method of Sharing, below.

b. Method

of Sharing

Equal sharing is

the preferred method but it is used only if all of the

other primary coverage forms permit it. Equal shares contribution means that each

insurance company contributes an equal amount until it uses up its limit of

insurance or the loss is paid, whichever occurs first.

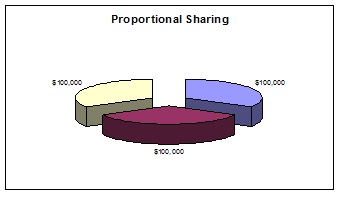

|

|

Example: The insured has three separate

Products/Completed Operations Liability Coverage Forms, all written in the

same name. When a loss occurs for which the insured is liable for damages,

all three respond. Policy A's each occurrence limit

is $1,000,000, Policy B's is $2,000,000 and Policy C's is $3,000,000. The

total amount of the judgment for which the insured is liable is $300,000.

Under contribution by equal shares, each of the three policies contributes

$100,000 for a total payment of $300,000. |

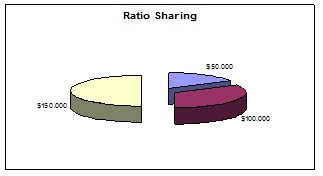

Contribution by proportional limits is used

when equal sharing cannot be used. Proportional limits contribution requires

the development of a ratio which is then applied to the loss. Ratios are determined based on each

insurer’s limit as a percentage of the total applicable limits. The loss is

then multiplied by the computed ratio to determine how much each company must

pay.

|

|

Example: Using

the previous example, Policy A's each occurrence limit is $1,000,000, Policy

B's is $2,000,000 and Policy C's is $3,000,000. The total of all limits

available to pay claims is $6,000,000. Company A has 1/6 of the obligation.

Company B has 1/3 of the obligation. Company C has 1/2. The total amount of

the insured's liability is $300,000. As a result, Company A pays $50,000,

Company B pays $100,000, and Company C pays the remaining $150,000. |

5. Premium Audit

a. All premiums are calculated according to

the insurance company's rules and rates.

b. The premium shown on the declarations as

an advance premium is only a deposit premium. At the end of each audit period,

the insurance company determines the actual earned premium for the period and

notifies the first named insured. The due date for the company to receive the

premium billed is the due date shown on the billing notice. However, when

advance and other premiums paid throughout the policy year are more than the computed

premium, the insurance company refunds the excess to the first named insured.

c. The first named insured is required to keep

the records and information the insurance company needs to do the premium

calculations. It must send copies of such records and information to the

company when requested to do so.

|

Example: Fernando’s Meats policy is issued effective 1/1/18 as follows: |

||

|

Rate: |

Sales |

Advance premium |

|

1.25 |

$2,000,000 |

$2,500 |

|

Fernando provides

his records to the insurance company in February, 2019

and his premium is calculated as follows: |

||

|

Rate: |

Sales |

Earned premium |

|

1.25 |

$3,000,000 |

$3,750 |

|

Fernando is sent

a bill for $1,250 ($3,750 - $2,500). The bill is due upon receipt. |

||

6. Representations

When the named insured accepts this coverage form as issued, it agrees

that the statements on the declarations are complete and accurate. It also

agrees that the policy is based on representations it made to the insurance

company. Furthermore, the named insured agrees that the policy was issued based

on those representations.

Note: This condition is important because it sets

the stage for rescission of the policy if it is determined that the named

insured misrepresented material information.

Related Court Cases:

Contractor Paints Itself into a Corner

Split Decision on False Statements in Application

7. Separation of Insureds

Each named insured is treated as though it is the only named insured.

There are two exceptions. The first is that limits of insurance apply over the

entire coverage form so each named insured does not

have access to its own set of limits. The other exception is that the first

named insured has certain extra policy-related responsibilities which are

described within the applicable conditions.

When insureds are faced with a claim or suit, each one is treated

separately. The only exception is that the limits of insurance apply over the

entire form so each insured does not have its own set

of limits.

8. Transfer of Rights of Recovery Against

Others to Us

Any rights the

insured has against others to recover all or part of any payment made by the

insurance company are transferred to the insurance company. The insured must

preserve those rights and do nothing after the loss occurs to impair them. The

insurance company can request that the insured bring suit

or transfer those rights to it. The insurance company also has the right to

request that the insured assist it in enforcing those rights.

Note: The enforcement can be very difficult on

insureds as they may be required to be the party to any lawsuits filed which

can result in lost friendships and adverse publicity.

|

Example: Marty’s Jewels, Inc. manufactures and sells earrings to a number of local retailers. All necklaces are required to be hypoallergenic. Paula sues Gina’s Jewels because she had a severe allergic reaction to an earring. Gina’s insurance company, Heartly Insurance, files a claim against Marty’s Jewel’s, Inc. because it manufactured the contaminated earring. Marty’s insurance carrier, Friendly Insurance, pays the retailer’s claim and then uses Marty’s rights of recovery to subrogate against Precise Metals who had supplied the contaminated metal used in the earrings. Marty is devastated when his close friend, the owner of Precise Metals, is forced into bankruptcy due to the lawsuit. |

9. When We Do Not Renew

The insurance

company must mail or deliver written notice if a decision is made to not renew.

The notice must be mailed to the first named insured at the address listed on

the declaration. The notice must be mailed at least 30 days prior to the

expiration date. The only evidence required that the notice has been mailed out

is a proof of mailing.

Note: This paragraph

is modified by specific endorsements in many states as to the number of days of

advance notice of non-renewal required, what is

considered acceptable as proof of mailing and the valid reasons to terminate or

not renew coverage. The requirements of each state must be evaluated carefully

when considering any changes or modifications of this condition.

SECTION V–DEFINITIONS

Defined words are

used throughout the policy. Restricting their meaning to the definition in the

policy provides the means for all parties involved with the policy to have a

clearer understanding of the coverage intended.

1. Auto (04 13 change)

A land motor vehicle, trailer or semi-trailer designed for travel on

public roads. Machinery and equipment attached to that land motor vehicle,

trailer or semi-trailer is also considered auto. A land vehicle that is subject

to compulsory or financial responsibility laws or motor vehicle laws where it

is garaged is also considered an auto.

The term does not include mobile equipment.

Note: The 04 13 edition removes the words “in the state” after “motor vehicle

laws” in the prior edition with respect to auto licensing or garaging

locations.

2. Bodily injury

Sickness or disease when it is sustained by a person is considered bodily

injury. Bodily injury that is sustained by a person is also bodily injury.

Death that results from bodily injury, sickness or disease is bodily

injury no matter when that death results.

|

Example: A machine

exploded. Jerry was struck by one of the flying parts. It lodged in his head

and could not safely be removed. Many years later he fell off a ladder,

dislodged the part and died. Even though the death was many years after the

initial injury, the death is considered bodily injury from that initial

bodily injury. |

3. Coverage territory

The United States of America, its territories and

possessions, Puerto Rico, and Canada. International waters or airspace are also

part of the coverage territory but only for injury or damage that occurs during

travel or transportation between points in the first sentence.

Coverage territory includes other parts of the world, if the injury or

damage arises out of the goods or products the named insured manufactures or

sells in the territory described above. However, this worldwide coverage is

limited because payment is made only when the damages are determined either by

trial in the territory described above or in a settlement agreed upon with the

insurance company.

4. Employee

This expands to include leased workers but not to temporary workers.

5. Executive officer

A person occupying any officer position. The named insured's charter,

constitution, by-laws or similar governing documents are the only documents

that can describe what an officer position is.

6. Impaired property

Tangible property that either cannot be used or is less useful than it

could be. It cannot be the insured’s work or product.

The reason for the loss of usefulness can be because the named insured's

product or work that is a part of the tangible property is dangerous ,

inadequate, defective or deficient or is alleged to be so.

|

Example: Jerry’s stamping machine was working well but a recent recall notice

states that any machine with a Ready Start switch could accidentally activate.

Jerry takes the machine out of service until the replacement switch is

delivered. That machine is impaired property. |

The reason for the loss of usefulness can also be the result of the named

insured not satisfactorily completing the terms of a contract or agreement.

|

Example: Gordon Millwrights have installed a luggage carrousel at the local

airport. All work is complete but the carrousel

cannot be used until all safety testing has been completed. The time period between the final installation and the safety

inspection is when the carrousel is impaired property. |

An important part of this definition is that the property must be capable

of being restored to use.

7. Insured contract

Consists of six types of

documents:

a. Lease of premises. This does not include a

part of any agreement that indemnifies others for fire to a

premises that is either rented to or occupied temporarily by the named

insured with the owner’s permission.

b. Sidetrack agreement

Note: A sidetrack

agreement is a contract between the owners of a premises and a railroad with

respect to a railroad transfer or access track on the insured property owner's

premises. The railroad agrees to let the insured use the sidetrack as long as the railroad is guaranteed access to it and the

owner agrees to certain conditions concerning maintenance of the property.

These agreements may also contain specific hold harmless agreements between the

property owner and the railroad.

c. An easement or license agreement. However,

those contracts connected with construction or demolition operations on or

within 50 feet of a railroad are not insured contracts.

d. Obligations to indemnify a municipality as required

by ordinance. However, those connected with actual work for that municipality

are not insured contracts.

e. Elevator maintenance agreements

f. A business-related contract or agreement in which the named insured

assumes the tort liability of another party and under which it must be pay for

bodily injury or property damage to a third person or organization. Contracts

or agreements that indemnify a municipality in conjunction with work done for

the municipality are included within this type of contract. However, the

following contracts and agreements in part or in whole are not insured

contracts:

·

Ones that indemnify a railroad for bodily injury or

property damage but only for such injury or damage that is due to construction

or demolition operations conducted within 50 feet of any railroad property.

That property must have to do with railroad bridges, trestles, tracks,

roadbeds, tunnels, overpasses or crossings

·

Ones that indemnify architects, engineers or

surveyors for injury or damage. The primary cause of the injury or damage must arise

from the preparation, map approval process, shop drawings, opinions, reports,

surveys, field orders, change orders, drawings and specifications, or the giving

or failure to give instructions or directions.

·

When an architect, engineer or surveyor insured

assumes liability for injury or damage arising out of its rendering or failing

to render professional services as described in the above paragraph or from supervisory,

inspection, architectural or engineering activities

Note: Tort liability is

liability imposed by law.

8. Leased worker

A person leased to the named insured by a labor-leasing firm. There must

be a written contract or agreement between the named insured and the

labor-leasing firm. The leased worker performs duties related to the conduct of

the named insured's business. Leased workers are not the same as temporary

workers.

9. Loading or unloading

The handling of property. It starts when the property is moved

from a place of acceptance onto an

aircraft, watercraft or auto. It continues while it is on the aircraft,

watercraft or auto and does not end until the property is at its final delivery

location. Movement of property by means of a mechanical device not attached to

the aircraft, watercraft or auto is not considered loading and unloaded unless

the device is a hand truck.

10. Mobile equipment

The following land

vehicles and the machinery attached to them.

a. Bulldozers, farm machinery, forklifts, and other

vehicles designed primarily for off-road use

b. Vehicles intended to be used only on or next to

the owned or rented premises

c. Vehicles that use crawler treads to travel

d. Vehicles used to provide mobility for the

described permanently mounted equipment. The equipment must be power cranes,

shovels, loaders, diggers or drills, or road construction or resurfacing

equipment such as graders, scrapers, or rollers. The vehicle is not required to

be self-propelled but it may be.

e. Vehicles not described in a., b., c., or d. above

and that are not self-propelled. They must be used to provide mobility for

permanently attached equipment. The equipment can be devices used to raise or

lower workers, such as cherry pickers. It can also be air compressors, pumps,

and generators, including spraying, welding, building cleaning, geophysical

exploration, lighting, and well servicing equipment.

f. Vehicles not described in a., b., c., or d. above

and used for purposes other than transporting persons or cargo.

Vehicles that are self-propelled with the

following permanently attached equipment are autos, not mobile equipment:

- Any item designed

to remove snow, maintain roads (other than to construct or resurface

them), or to clean streets

- Any items mounted

on automobile or truck chassis and used to raise or lower workers or

equipment, such as cherry pickers

- Air compressors,

pumps, and generators, including spraying, welding, building cleaning,

geophysical exploration, lighting, and well servicing equipment

Mobile equipment does

not include any vehicle subject to compulsory or financial responsibility laws

or motor vehicle insurance laws where it is licensed or garaged. These vehicles

are treated as autos. The 04 13 edition

removes the words “in the state” after “motor vehicle laws” in the prior

edition with respect to auto licensing or garaging locations.

11. Occurrence

An accident. It includes continuous or repeated exposure to essentially

the same harmful conditions.

12. Products/completed operations hazard

Bodily injury and property damage that occurs away from premises or

locations the named insured owns or rents and arising out of its products or

work. It does not mean:

- Products that remain in the named

insured's physical possession

- Work not considered either completed or

abandoned.

Work

is considered completed when the work called for in the named insured’s

contract has been completed. When there is a contract for work at multiple

sites, the work at one site is considered completed even if there is still work to be done at other sites. Whenever part of work done

at a site is put to its intended use by any party, other than a contractor or

subcontractor still working on the same project, that part of the work is

considered complete. Work is considered completed, even if it may still need

service, maintenance, correction, repair, or replacement.

This definition does not include bodily injury or

property damage that arises from any of the following:

- Transporting

property. However, coverage applies if a condition in or on a vehicle not

owned or operated by any insured created by loading or unloading that

vehicle by any insured causes the injury or damage.

|

Example: Massive Art Supplies hires Good Hauls, Inc. to

transport various paints to its clients from Indiana to California. The

product arrives and is sold at local outlets. Artists buy the paints and

notice the paint does not adhere or have true color resulting in multiple

claims because of work having to be redone. An investigation reveals that

Good Hauls, Inc. neglected to activate its refrigerating unit during the long

trip. Massive Art Supplies is covered for the products losses because of the

exception to this definition. |

- The existence of tools, uninstalled

equipment, or abandoned or unused materials

- Products or operations with a classification

on the declarations or a schedule that states that the products-completed

operations is subject to the General Aggregate Limit

13. Property damage

- Physical injury to tangible property. The

resulting loss of use of that property is included in the physical injury

loss. It is treated as having occurred at the same time as the physical

injury that caused it.

- Loss of use of tangible property not

physically injured is also property damage. The loss of use is treated as

having occurred at the time of the particular occurrence

that caused it.

Electronic date is not considered tangible property. Electronic data is

information, facts or programs stored as or on, created or used on or

transmitted to or from computer software or any other media used with

electronically controlled equipment.

Note: This is extremely important and limiting! Its importance cannot be

overemphasized. If the named insured passes a computer virus to another party's

computer in any way, and that virus destroys important data on that computer,

previous editions might have covered it. That is no longer the case with this

definition.

14. Suit

A civil proceeding alleging damages resulting from bodily injury or

property damage covered by this insurance. Arbitration proceedings or any other

alternative dispute resolution proceeding in which such damages are claimed are

considered suit only if submitted to by the insured with the insurance

company's consent.

15. Temporary worker

Any person furnished to the named insured as a substitute for a

permanent employee who is temporarily away from the business. Also a person furnished to meet seasonal or short-term

workload conditions.

16. Your product

Any goods or products

manufactured, sold, handled, distributed or disposed of by the named insured,

by others that trade under the named insured’s name, or by any party whose

business or assets the named insured acquired. Your Product includes containers

(excluding vehicles), materials, parts, or equipment furnished in connection

with such goods or products.

Your product does not include

real property.

Your product is also

warranties or representations made concerning the fitness, quality, durability,

performance, or use of the product and providing (or failing to provide)

adequate warnings or instructions.

Your product is not

vending machines or other property rented to or located for the use of others

but not sold.

17. Your work

Work or operations done by the named insured or on behalf of the named insured, and the materials, parts or equipment furnished in connection with such work or operations.

Warranties or representations made at any time concerning the fitness, quality, durability, performance or use of the named insured's work are considered your work. The providing or failing to provide warnings or instructions is also considered your work.

CG 00 39–PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE FORM–CLAIMS-MADE BASIS

The header section of this coverage form states in bold letters that Coverage A and Coverage B provide claims-made coverage with the admonition to read the entire form carefully. This statement is intended to alert the named insured to the fact that certain parts of this coverage form are different than in the occurrence coverage form.

This analysis addresses only the five parts of the claims-made form that differ from the occurrence form.

- Section I–Coverage–Bodily Injury and Property Damage Insuring Agreement

- Section IV–Products/Completed Operations Liability Conditions (Duties In The Event Of Occurrence, Claim Or Suit)

- Section IV–Products/Completed Operations Liability Conditions (Other Insurance–Excess Insurance)

- Section IV–Products/Completed Operations Liability Conditions (Your Right To Claim And Occurrence Information)

- Section V–Extended Reporting Periods

Note: The WHO, WHAT, WHERE, and HOW aspects

of coverage are unchanged. The differences are based on WHEN.

COVERAGE

1. Insuring Agreement summary:

- The differences between the two forms

in subparagraph b. are the reasons there are two CGL forms. All other

differences emanate from this subparagraph. In item b. (2) in the CG 00 37

the bodily injury or property damage must actually

happen during the policy period. In the CG 00 38 the bodily injury

or property damage must happen after the retroactive date but before the

end of the policy period. The importance here is that if the retroactive

date is five years prior to inception, there are six years in which bodily

injury or property damage might have happened and that could be covered by

the form. Under the CG 00 37, the bodily injury or property damage must

happen within the policy period.

- In paragraph b.(3) a limitation is

imposed in the CG 00 38. The first claim for damages must be presented

during the policy term or during the police’s extended reporting period.

Paragraph c. explains how important the first notice of claim is. That

first notice sets the date for all claims that relate to the first claims.

- CG 00 37 does not discuss when claims

are made because that does not impact its coverage. However, paragraphs b.

(3), c, d. and e. are required to explain exactly when an insured has

knowledge of bodily injury or property damage. The policy in which that

knowledge is first gained is the only policy that will respond to any and all claims related to the bodily injury or

property damage.

|

Example: The policy period is 01/01/18 to 01/01/19 when coverage is written on a claims-made basis for the first time. It subsequently renews twice, each time on a claims-made form. Three claims are reported during the time period. Claim #1 is a 12/01/017 bodily injury reported on 01/15/18. Claim #2 is a 05/01/18 property damage reported on 12/01/18. Claim #3 is a 02/01/18 bodily injury reported on 06/01/16. |

|

Scenario 1: The retroactive date changes to match the effective date of each policy term:

|

|

Scenario 2: The retroactive date is the effective date of the first claims-made policy.

|

|

Scenario 3: The retroactive date indicated on the declarations is "None."

|

All claims for damages because of bodily injury to the same person are treated as having been made at the time that the first of those claims was made against any insured.

|

Example: Brian is unloading a semitrailer when the lift on the truck malfunctions and crushes his foot. A claim for his medical bills is presented to Sims Truck Lifts, Inc. on 07/01/17. Brian’s wife sends notification of her claim for loss of consortium to Sims’ insurance company. On 03/01/18, Brian dies due to complications from the foot surgery so his family files a wrongful death claim against Sims. On 09/01/18, Brian’s workers compensation carrier subrogates against the insured for the costs of the injuries he sustained that it paid. Each of these claims is treated as having the initial claims-made date of 07/01/17. |

All claims for damages because of

property damage causing loss to the same person or organization are treated as

having been made at the time that the first of those claims was made against

any insured.

SECTION IV–PRODUCTS/COMPLETED OPERATIONS LIABILITY CONDITIONS

The CG 00 38, Condition 2. Duties In The Event Of

Occurrence, Claim or Suit, subparagraph a. has an entry not found in the

occurrence form. It states that notice of an occurrence is not notice of a

claim. Subparagraph b. in the CG 00 38 states that if a claim is received by

any insured, the named insured must immediately record the specifics of the

claim and the date received and notify the insurance company as soon as

practicable. The named insured must also ensure that the insurance company

receives written notice of the claim as soon as practicable.

Note: The term suit does not appear in the

claims-made form.

|

Example: On 08/01/17, Pamela witnesses one of her restaurant’s customers choking on her food and expressing concerns about her food allergies. After the customer’s breathing improves, Pamela questions her cook about the ingredients in that customer’s meal. Meanwhile, the customer and the rest of the table leave. Pamela notifies the insurance company of the occurrence on the same day. On 06/15/18 Pamela receives papers informing her that the family of the customer is suing because she died as a result of the food she ingested at the restaurant. If Pam had claims-made coverage in force during the time period, the claims-made date is 06/15/18, not 08/01/17, and the coverage in force as of 06/15/18 responds, provided the retroactive date is prior to 08/01/17. |

Condition 4. Other Insurance, subparagraph b. Excess Insurance is an

addition. The occurrence form coverage is always primary so there is no excess

provision. This excess provision states that this insurance is excess over any

other insurance that is not written as claims-made. That other insurance must

be effective prior to the inception date of this policy and apply to bodily

injury or property damage. Furthermore, this policy is excess only if either of

the following is true:

- A retroactive date is not shown on the

declarations of this insurance

- When there is a retroactive date on

this policy, the policy period of the other insurance must continue beyond

that date.

|

Example: Continuing the restaurant example above, if occurrence coverage was in effect on 08/01/17 and claims-made coverage was in effect on 06/15/18 with a retroactive date prior to 08/01/14, the occurrence coverage is primary and the claims-made coverage is excess. |

Condition 10. Your Right to Claim and

Occurrence Information in

the CG 00 38 does not appear in the occurrence form. This condition details the

claims-made claim information the insurance company is required to release. The

detailed analysis follows.

10. Your Right to

Claim and Occurrence Information

The insurance

company provides the first named insured information relating to any

claims-made products/completed operations coverage issued to it during the

previous three years. The information that must be released is:

- Some type of record describing every

occurrence notice the insurance company received. The record is not

required to include notices of occurrences that were reported to prior

carriers. The description must include the date plus a brief description

of the occurrence but only if such information was in the initial loss

notice received.

Note: The named insured’s reporting will

determine the type of reports it can expect. If its initial notices are skimpy,

this report will also be skimpy.

- A policy-year summary of payments made and reserve amounts are provided but only those

that are under the Aggregate Limit.

Reserve amounts are

based on the insurance company's judgment, are subject to change at any time

and without notice, and should not be considered as

final settlement amounts.

The released

information could compromise claim negotiations, so the policy prevents the

named insured from disclosing or providing it to claimants and/or their

representatives without its prior consent.

If the insurance

company decides to cancel or not renew the coverage provided, this claim

information must be provided 30 days or more prior to the cancellation or

non-renewal date. In all other cases, it will provide this information only if

a written request for such is received from the first named insured within the 60

days following the expiration date. The insurance company must provide the

requested information within 45 days of the request date.

The insurance

company provides a disclaimer. It makes no representations or warranties as to

the accuracy of the information. Cancellation or non-renewal is still

effective, even if the information provided is not accurate.

|

Example: Pelican, Inc. has been insured on a claims-made Products/Completed Operations Liability Coverage Form written by Creative Insurance Company for the past three years. Creative notifies Pelican that it is not renewing coverage and provides Pelican with two different reports. The first report reads as follows: |

||

|

Date of loss |

Loss description |

Remarks |

|

12/8/15 |

Property struck claim |

10 storefronts |

|

5/5/16 |

Child injury claim |

1 child – under 5 years old |

|

8/7/17 |

Property struck claim |

Bridge |

|

This report does not include ten other occurrences included on a similar report received from its previous carrier. The second report reads as follows: |

||

|

Policy period |

Amounts paid |

Amounts reserved |

|

01/01/15-01/01/16 |

$35,000 |

$0 |

|

01/01/16-01/01/17 |

$25,000 |

$400,000 |

|

01/01/17-01/01/18 |

$15,000 |

$150,000 |

SECTION V–EXTENDED REPORTING PERIODS

This section is

found only in the claims-made coverage form. It does not appear at all in the

occurrence coverage form. This section explains how the extended reporting

periods work.

1. The insurance

company provides one or more described Extended Reporting Periods. It is provided

if this coverage is cancelled or is not renewed by either the named insured or

the insurance company. It also applies if the insurance company replaces or

renews the current policy with insurance that has a later retroactive date than

the one shown on this declarations or with coverage

provided is on other than a claims-made basis.

2. Extended

Reporting Periods do not change the nature of the coverage provided or extend

the coverage period. These periods apply only to claims for bodily injury or

property damage that actually occur before the end of

the coverage period and after any retroactive date on the declarations.

3. A Basic Extended

Reporting Period is included automatically and without any additional premium

charge. It begins at the end of the coverage period. It lasts for:

- Five years for claims because of bodily

injury and property damage but only if the occurrence from which they

arise was reported to the insurance company no later than 60 days following

the end of the policy period. The claim must be reported based on the

terms in Section IV–Duties In The Event Of Occurrence, Claim Or Suit.

- Sixty days if the claim is due to an occurrence

that had not yet been reported to the insurance company.

Claims covered under any subsequent insurance coverage the named insured

purchases or that would be covered except for the limit of insurance applying

to such claims being used up are not eligible for coverage under this Basic

Extended Period.

4. The Basic

Extended Reporting Period uses the same limits available to the rest of the

insurance policy.

|

Example: Major Insurance Company non renewed Realistic’s P/CO coverage, triggering the Basic Extended Reporting Period. Realistic's P/CO coverage had been on a claims-made basis for the past four years. The retroactive date was the date of the first claims-made policy and had never changed. The first claims-made coverage was effective 01/01/16 and the last claims-made P/CO coverage form expired 01/01/18.

|

5. A Supplemental

Extended Reporting Period is available by endorsement and for an additional

premium charge. It is of unlimited duration and begins when the Basic Extended

Reporting Period ends. The onus is on the named insured to request the

endorsement. It must do so quickly because if the named insured has not

requested this endorsement within 60 days following the policy expiration date,

the endorsement is no longer available at any cost. The premium is due promptly

and coverage does not go into effect until after it is paid. The premium will

be expensive but is capped at no more than 200% of the annual premium of this particular policy. The insurance company is required to

consider exposures, insurance limits and types of insurance, limits available

to pay for future claims and other relevant factors when setting the price. CG

28 34–Supplemental Extended Reporting Period Endorsement or CG 28

35–Supplemental Extended Reporting Period Endorsement for Special Accident,

Products, Work or Locations must be attached to explain the terms and

conditions specific to this reporting period.

6. A supplemental aggregate limit of insurance becomes available when the Supplemental Extended Reporting Period is in effect. The limit applies only for claims first received and recorded during the Supplemental Extended Reporting Period and is equal to the dollar amount on the declarations in effect at the end of the policy period.

Menu (click here to expand or to collapse)

Menu (click here to expand or to collapse)